Top

search here ...

People also search for:

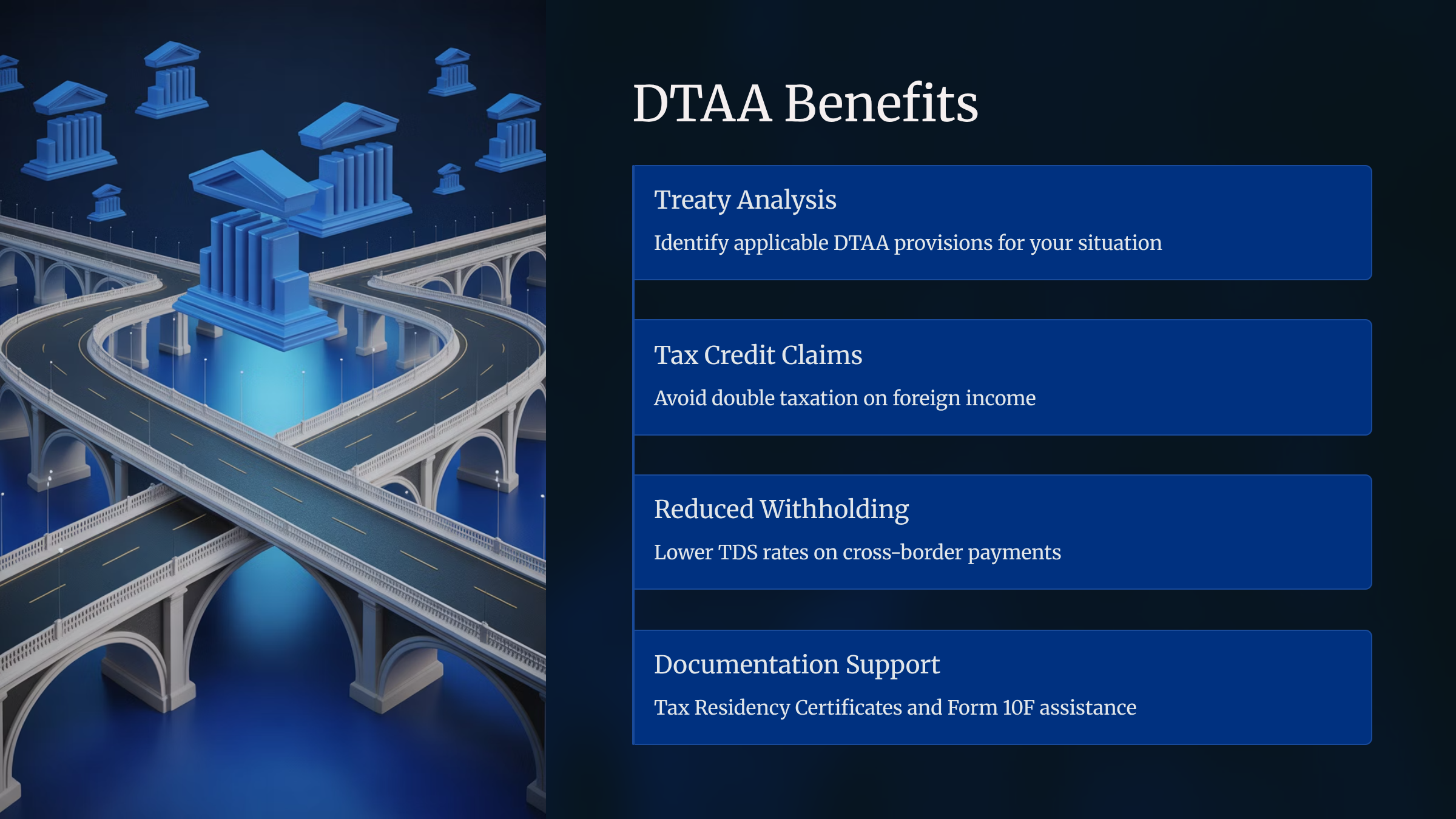

We help you claim DTAA benefits correctly for income such as:

- Salary

- Freelance income

- Interest

- Dividends

- Capital gains

- Royalty

You pay tax only once—either in India or your country of residence—based on treaty rules.